Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Key takeaways

Schiff claims that Bitcoin is in a long-term bear market when valued in gold.

Gold’s rebound above $5,000 reinforced the narrative shift toward real assets.

Schiff also criticized US political support for crypto.

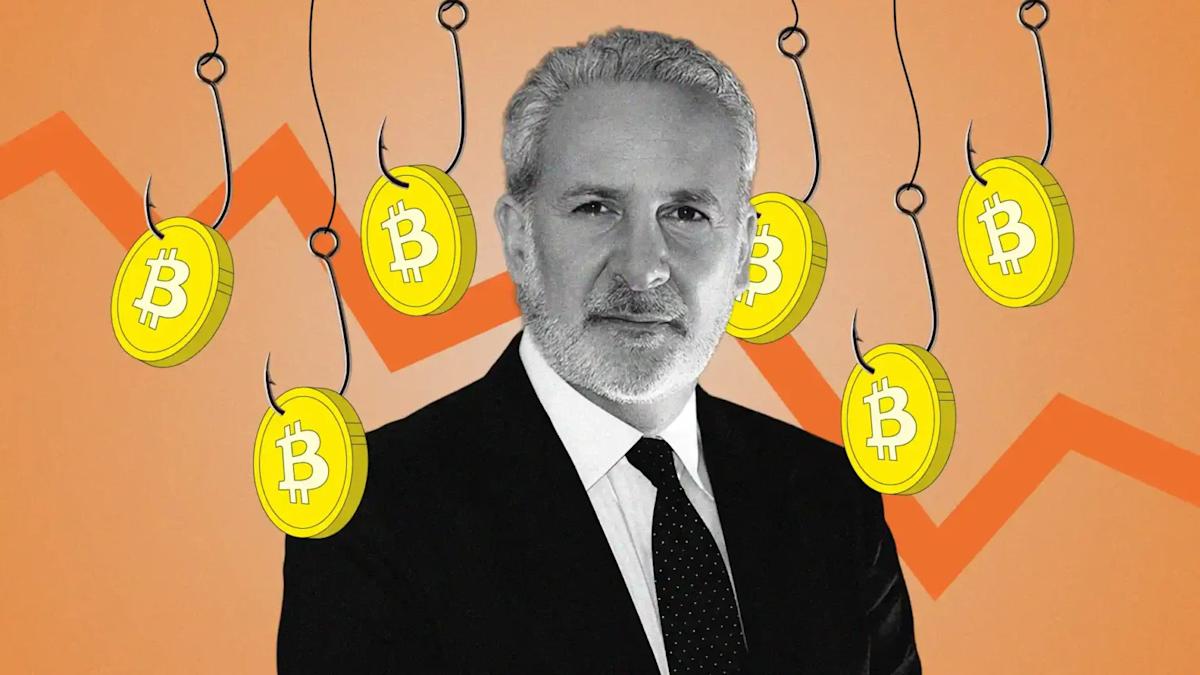

Peter Schiff has reignited the debate over whether Bitcoin entered a prolonged bear market with the price of gold, as the price of Bitcoin continued to fall and gold rebounded sharply.

Schiff, critic of Bitcoin also argued that China was “too smart” to get involved in Bitcoin, pushing back against recent comments from President Donald Trump.

Schiff highlighted Bitcoin’s performance when valued in gold rather than US dollars, saying it has entered a bear market.

“It didn’t take long. Gold is already back above $5,000,” Schiff wrote in an article on X on Wednesday.

“Bitcoin is in a long-term bear market, priced in gold,” he added.

In a follow-up article, Schiff defended his methodology for valuing Bitcoin against the precious metal.

“Well, gold is real money, and Bitcoin is supposed to be digital gold,” he wrote. “So it makes more sense to price it in gold. »

Bitcoin proponents typically measure gains in dollars. Schiff, however, has repeatedly argued that adjusted gold prices provide a clearer picture of purchasing power and long-term value.

In addition to claiming a Bitcoin bear market, Schiff also took the opportunity to criticize political support for crypto in the United States, contrasting it with China’s focus on industrial investments and gold accumulation.

“Trump says he believes in cryptocurrencies and wants to make the United States the Bitcoin capital of the world, because if we don’t do it, China will,” Schiff wrote.

China has steadily increased its official gold reserves in recent years, while maintaining tight controls on cryptocurrency trading and mining.

On Monday, Trump said: “…I’m a huge crypto enthusiast. I’m the one who’s probably helped crypto more than anyone else because I believe in it.”

“If we don’t do it, then China will. Right? If we don’t do crypto, then China will. And it’s like AI. We’re far ahead of AI.”

“And if we hadn’t been in the lead, China would have. They’re very capable. They’re very good.”